Malaysia has recently announced a new road tax structure for electric vehicles (EVs) that will come into effect in 2026. This new structure aims to provide a more balanced and sustainable approach to taxing EVs while still encouraging their adoption.

Here’s a breakdown of the key points:

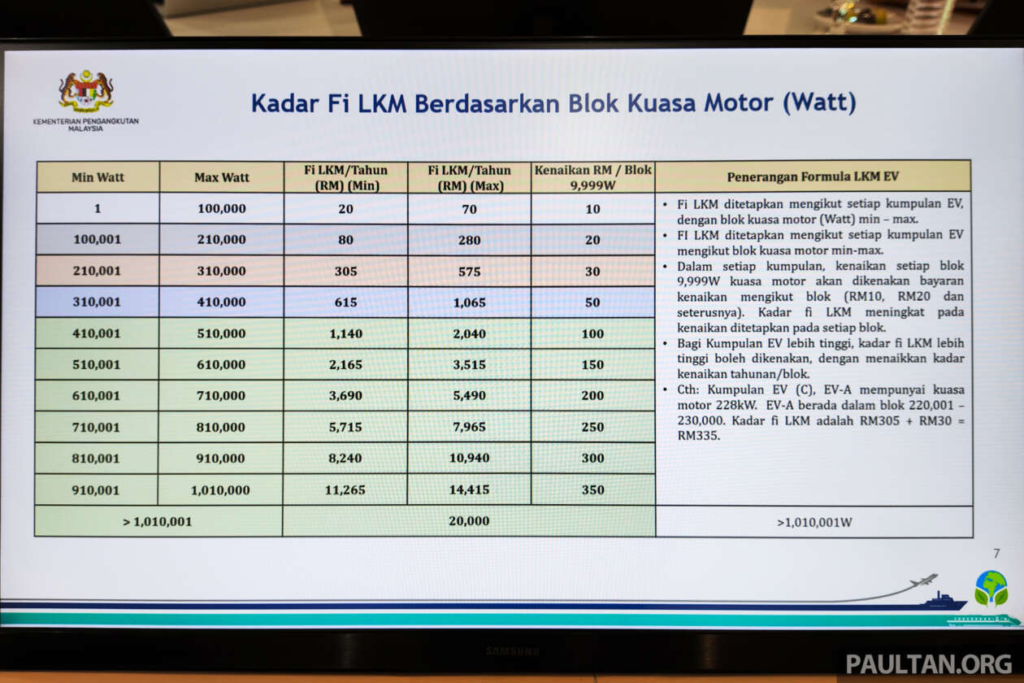

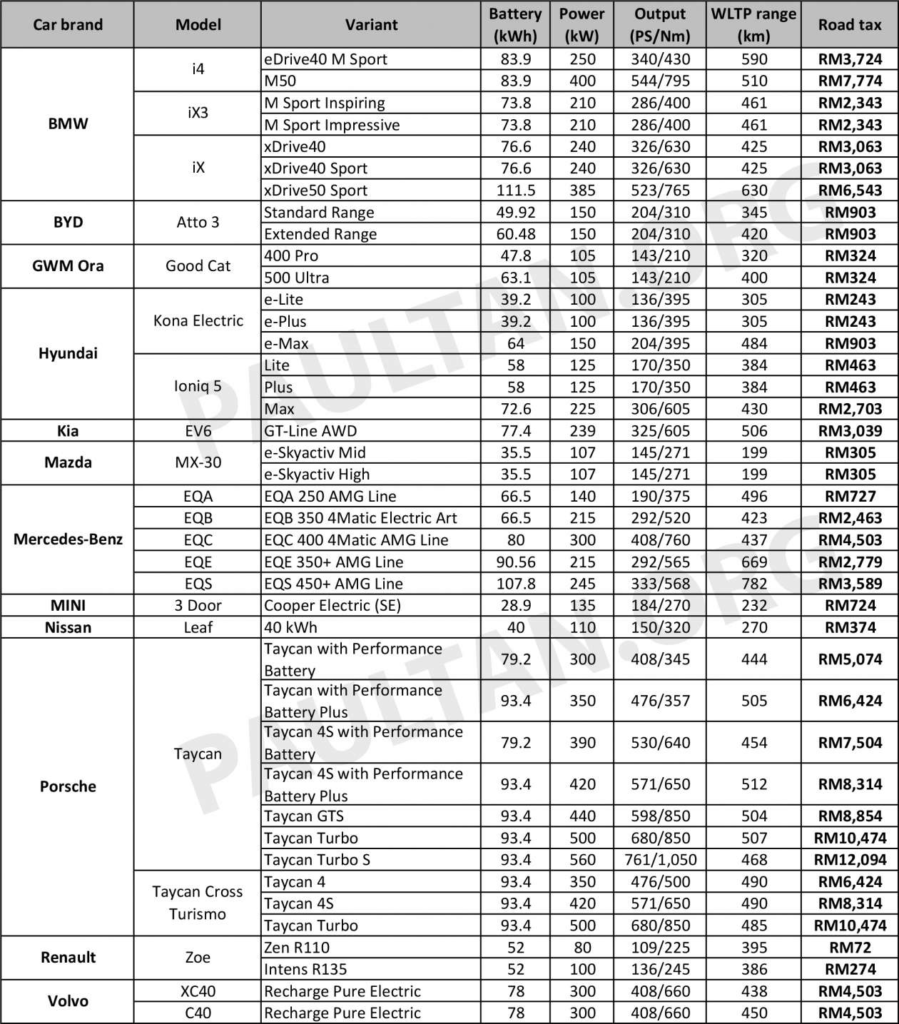

- Based on Motor Power Output: Unlike the current road tax system based on engine displacement, the new structure will tax EVs based on their motor output measured in kilowatt (kW). This aligns the tax amount with the road usage and potential wear and tear caused by the vehicle’s weight.

- Tiered System with Block Rates: The new structure divides EVs into different power output groups (tiers). Each tier has a base rate, and the tax increases incrementally within the tier based on additional power blocks (usually 9.9 kW). This ensures a progressive increase in tax for high-powered EVs.

- Significant Reduction from Current Rates: The Malaysian government has assured that the new EV road tax will be significantly lower than the current rates (which are currently suspended until the end of 2**025). Estimates suggest a reduction of up to 85% compared to traditional road tax for petrol vehicles.

- Example: Let’s say a typical EV has a motor output of 150 kW. This would likely fall under Group B of the new structure (ranging from 100.001 kW to 210.000 kW). With a base rate of RM80 and an increment block fee of RM20 per 9.9 kW block for this group, the total road tax for this specific EV would be around RM160 annually.

Benefits of the New Structure

- Fairer System: The new structure taxes EVs based on their actual road usage and environmental impact, creating a fairer system compared to the current displacement-based tax.

- Promotes Sustainable Transportation: By keeping EV road tax low, the government aims to incentivize EV adoption and accelerate the transition towards a more sustainable transportation sector.

- Long-Term Sustainability: The tiered structure with progressive tax rates ensures the system remains sustainable in the future as EV technology advances and potentially becomes more powerful.

Overall, the new EV road tax structure in Malaysia represents a positive step towards a more balanced and sustainable approach to electric vehicle taxation. It offers a significant reduction in costs for EV owners while still ensuring fairness and long-term sustainability.

Note: It’s important to stay updated on the official government channels for the latest details and implementation of the new EV road tax structure.